Please see below link for users starting with TINO IQ

https://medium.com/@tinoiq/how-to-use-tino-iq-to-make-money-52a4efced4f1

TINO IQ’s algorithms scan all stocks every day. If an algorithm finds a pattern, then TINO IQ’s quality module verifies the effectiveness of this pattern as suggested by the algorithm. Once the effectiveness of the pattern is validated, the stock is made available on the TINO IQ app. Generally less than 1% of all stocks pass through this rigorous test on a daily basis.

TINO IQ’s database currently has only Blue Chip stocks with a good trading volume. This enables our clients to trade-into/out of the trades easily. We can add some penny stocks with good volume.

Very few stocks pass through our strict quality checks, and we are not like many companies who claim success if 1 out of 100 predictions work. For us every prediction should work. We openly provide all metrics to the user, where they can see what happened in the last 20 years when Algorithm X gave a buy/sell signal for Symbol Y.

Yes, we can and we do – However it’s not possible for us to trade in all the market’s / stocks every day. Essentially we have the same level of access as Gold plan members.

We don’t predict too many stocks, and our proprietary algorithms capture trading patterns from multiple angles. This enables us to find small and actionable trading opportunities. We have spent many years building algorithms which track patterns where people are trying to artificial manipulate a stock. All these algorithms help our clients to make a rational decision when pressing that buy/short button. We would have to fill up a page telling about more features. Please take a look around our site and see for yourself.

Market’s move every day, so getting a good entry/exit point is vital. If the stock has gap up then you should wait till the price of the stock is at or below the suggested price. If you don’t get this price in 1 or 2 days, it’s better to skip this trade and look for other stocks.

We currently analyze all stocks of Dow 30, S&P 500 and Nasdaq 100 Index. Additionally we have some ETFs from Vanguard, Proshares and IShares. We will be adding more stocks/ETFs regularly to TINO IQ.

Yes. This means that stock is expected to be volatile in the next few weeks and would trade both up/down. In our research, we have found placing limit orders helps to get a stock at the best price.

Let’s say the prediction is for a stock to gain 2% on 10/1/2015 when the stock is currently trading at $100. This means the stock is expected to touch $102 within the next 5 days. We strongly recommend you immediately take profits when it reaches $102, as stocks can come back to $100 or go even down. Similarly a stock can go up to $105 or $110. We believe in taking consistent, predictable profits as compared to hitting the jackpot one day and losing it the other day.

You toss a coin and want a head to come. The probability of that happening is 1 in 2 outcomes. Hence probability is 50%. For predicting TINO IQ’s result we calculate all the possible outcomes and present this number to you as probability.

Many of our customers are using TINO to trade options. However people are trading options at their own risk. We believe options trading needs to consider factors like time decay, implied volatility and more in a different way than stock trading. We are working on a module specifically catering to option trading recommendations, targeted to release in ( Let’s keep that secret 🙂 )

No. The algorithms look at patterns each day and then compute the probability of a stock going to the expected price within the next 5 days. Once the target price has been reached the algorithm has already done its work. If you are trying to repeat the trade, you are trying your luck.

Every stock has its own characteristic response to market forces. A stock’s character changes depending on people trading the stock or events happening in that company. Each algorithm captures this character in a different way. Think of algorithms as tools which can help you find the pattern on a stock today

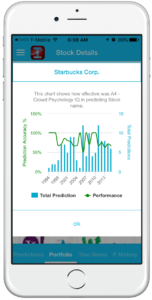

We treat our predictions very strictly, even if the stock misses its prediction by 1 cent during the prediction period, we consider it a failure. We think it is better to be conservative – hence we follow this strict approach.The probability number today is not an average of the past predictions. It is a number generated by an algorithm today based on today’s market conditions. The Quantum Analytics chart is very useful in understanding how the algorithm has been successful in predicting the stock in the pastThink about it — how many companies show you predictions they have made in the past and what happened to those predictions? Remember, Dot-com boom, housing bust etc. Companies just give reason to say why their predictions were not right. By the time they give predictions, it’s too late – people have already lost money.This is why we are being honest and transparent about every single prediction we make.

We treat our predictions very strictly, even if the stock misses its prediction by 1 cent during the prediction period, we consider it a failure. We think it is better to be conservative – hence we follow this strict approach.The probability number today is not an average of the past predictions. It is a number generated by an algorithm today based on today’s market conditions. The Quantum Analytics chart is very useful in understanding how the algorithm has been successful in predicting the stock in the pastThink about it — how many companies show you predictions they have made in the past and what happened to those predictions? Remember, Dot-com boom, housing bust etc. Companies just give reason to say why their predictions were not right. By the time they give predictions, it’s too late – people have already lost money.This is why we are being honest and transparent about every single prediction we make.While analyzing a stock you might come across, “I want more of these kinds of stocks”. This is where correlation comes into picture. With the correlation screen you can find stocks which have similar trading patterns.

Let’s take an example: Stocks X and Y had a 98% correlation from Jan-Jun, however, had only a 84% correlation from July-Aug. TINO currently shows correlation of over 90%, hence you would not see the correlation for 6 months.

Yes. In the initial years, we did not get any good results. Actually after working on it for nearly 7 years, we thought of giving up. However in early 2015 we started getting some good output and then started building an app. We are fully dedicated to building better algorithms and will continue to build new and improved existing algorithms

Around 8:00 pm PST we post the predictions for the next day. If there are any data issues, then we try to get the prediction engines working before 6:30 am PST. You do not have to open and close or login/logout to see the new predictions. The predictions will appear automatically

Trading of anything is a risk – Think about trading as a game where money is just exchanged from one hand to another – So for you to win someone is losing. At TINO IQ our philosophy is to have repeated, good small trades rather than one large trade. Putting a lot of money on one trade is risky, hence please look and understand the quantum analysis chart “before” making any trade. As you become more comfortable using TINO IQ algorithms, you will understand which algorithm to choose and where to put the bet. Please see http://trustedfinancialadvisor.org/live_portfolio.html to see how we are ahead of literally every hedge fund out there.

Yes and No. We have it for a few algorithms and are working towards making it available for other algorithms.

Each week we issue a report to members showing the success rate of all trades. Conservatively, the odds of success are three in four for the predictions.

We aim to put only “actionable” information in the app. General information does not have a place in the app. For any “general” information we provide links to various websites where people can see that information.

This indicates that algorithms have detected irrational price movements in the stock. These are generally associated with pump and dump patterns normally observed in the market. A stock with this message can continue to “irrationally” move up or down. This is why please refer to price targets to take small profits along the way and adhere to the stop loss targets.

Even though our predictions time-range is for 5 to 10 days, historically many predictions have been successful in a day itself.

Additionally, in the app, you can see what popular indicators (RSI, MFI, stochastic etc.) are telling about the stock and how good these indicators have been in predicting stock movements correctly.

On the website: https://www.trustedfinancialadvisor.org There are lot of tools for find good day-trading stocks:

Scan stocks using AI for candlesticks and find stocks which are being recommended most

https://www.trustedfinancialadvisor.org/candlestick-strategies.html

Find which insiders are buying or selling your stocks

https://www.trustedfinancialadvisor.org/insider-trading.html

Full Probability simulation of expected price for your stocks for next 10 days

https://www.trustedfinancialadvisor.org/portfolio.html

The live portfolio is strictly based on getting exact buy/sell as shown in the app